Between 2012 – 2014 the Central Estern Europen (CEE) IT makets will register at least a double growth rythm in comparison to the GDP growth rate of the area, minimizing the difference to western countries. Surging interest for mobile technologies and cloud computing and absorbtion of non-refundable European financial grants will push the IT market growth in Romania as high as 12.7% in the coming years – a recent study by Erste Group revels, based on data from the European IT Observatory. IT spending will grow by 8 to 15 percent in 2012, especially in countries like Poland, Romania, Bulgaria and Croatia. Factors that will generate the growth of IT budgets are related to the need to reduce costs and increase operational efficiency, but also the need to increase labor mobility and flexibility of IT systems in general. Another indication of the study is that this favorable context opens the opportunity of a new wave of mergers and acquisitions, especially among small IT companies that are flexible and rapidly absorbing the new technologies.

Growth generating factors

While Western European markets experience a static evolution, Erste analysts consider that in CEE businesses are more dynamic and therefore more willing to invest in IT. Therefore, in 2012 expected increase in the IT market is forcasted to stands at 7.8% in Poland, 10.1% in Croatia, 12.7% in Romania and 15% in Bulgaria. Erste Group officials involved in the study found that a major factors contributing to the IT market increase in the CEE region are:

a) fundamental factors (structural and cohesion funds, public projects for legal compliance with the EU accession);

b) technological factors related to current industry trends (cloud computing and service-oriented IT, mobility, new generation communication networks).

Add to this the constant need for efficiency and cost reduction and compliance with industry standards or management of large data volumes. Also, many companies will be eager to gain market share rapidly amid recovering market conditions and therefore engage to invest in IT tools to achieve these objectives.

Cloud Computing (CC) is an area especially attractive for small and medium enterprises (SMEs) and start-ups The central idea behind cloud computing is accessing an IT system (applications, platforms, infrastructure) on a monthly subscription basis, eliminating the need for high upfront investments (licenses, equipment, consulting) that are somewhat inaccessible for many companies in the SME category. Due to lack of capital, these companies will be attracted to the cloud model and will generate significant service level revenue increase. Since the SME segment is the core of CEE economies, accepting the concept of IT as a service should have an impact on the market increase.

Mobility and new-generation communications networks. Telecom operators in the region are very dynamic, therefor state-of-art and networks are on hand. Telecommunications costs are low and therefore accessible to a wide range of users. Also, sales of smartphones and tablets are growing in most markets. Official figures show that mobile phone penetration rate is at 82% and mobile data is growing exponentially. 26% of mobile devices sold in Q3 2011 were smartphones. This conjecture provides major opportunities for developing mobile applications, video streaming, machine to machine communications and mobile payments.

Need for efficiency and operational costs reduction. Many companies in the region have developed naturally in the pre-crisis and now they need the tools to effectively manage an activity not very well optimized. Therefore, it is necessary to implement management solutions to provide the relevant information in real time and to support decision-making.

Structural and Cohesion Funds are the main financial source of public projects in most countries in the region. Even if funds are granted throughout a number of years, the amount of money received is impressive and of impact on the IT market. For Romania, Erste study recalls the figure of EUR 252 million.

Acquisitions and mergers. According to Erste analysts in the region, IT companies dispose over a very good financial situation and very little debt, therefore, given the availability of capital to key players, we see a series of acquisitions and mergers that will have a positive influence on the market. According to the study SAP, HP, Oracle, Google, Sofware AG, IBM and Asseco can be seroius potential buyers.

Entrepreneurship in the CEE region

The current ascending IT market trend will most likely trigger foreign investment interest and boost local entreprenorial activity in the CEE region. Recently Intel Corporation has opened a R&D center in Romania, Intel Romania Software Development Center, employing 350 IT specialists for open source software development. Moreover, SAP AG, in a partnership with Samsung, has joined forces between subsidiaries in Romania to promote business and mobile applications locally.

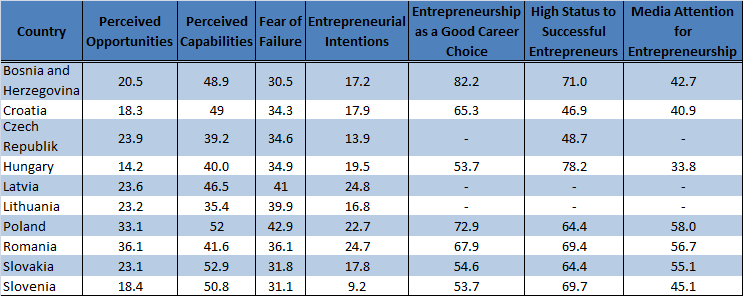

Table 1.: Entreprenorial Intentions, Perceptions and Social Attitudes in 2011. Source: GEM 2011 Global Report.

Romania ranks second in the CEE for entrepreneurial intentions in 2011, with 24.7 points, according to the Global Entrepreneurship Monitor (GEM) 2011 Global Report. Latvia ranks first with 24.8 points. Romania is followed by Poland, Hungary, Croatia and Slovakia.

IT Salaries in Romania

Key considerations regarding the Romanian IT market growth show that the IT industy is defying recession with success. IT is the only industy registering an increase in the number of employees during this period. Presently Romania employs 28.400 IT specialists, 30% more than at the end of 2008. Moreover, IT salaries have increased by 54% since the beginning of the crisis, because IT products are sold well abroad, and the state offers tax incentives to employers who recruit software developers. So far, average wage in this sector reached EUR 870 net, being 2.5 times higher than the national average, according to data from National Institute of Statistics.

In 2011 the number of employees increased slightly in the telecom sector as well, but employers are mainly looking for software developers for smartphones (offering salaries between EUR 800 and 1000) or network engineers, for which salaries start to EUR 600.

Salaries in outsourcing vary widely depending on the number of languages known: if those who know English only receive net salaries starting at EUR 400, those who know a Nordic language, for example, in addition to English, can win over EUR 1000.

The gross average wage in Romania was up by 3.3 percent in March this year compared to the same month of 2011, to EUR 487, according to data from the country’s Statistics Institute (INS). Net nominal average earning was EUR 353, up from previous month by 4.8 percent, the highest values being recorded in the tobacco industry and lowest in hotels and restaurants, according to figures announced by the National Institute of Statistics. (T.Sz).